The History of the Balance Sheet

Blog Updated September 15, 2025

Key Takeaways

Three chickens standing around

The balance sheet originated in the 15th century with Luca Pacioli's double-entry bookkeeping system in 1494

Modern QuickBooks automation has transformed balance sheet management from manual, error-prone processes to real-time, accurate reporting

2025 best practices emphasize automated reconciliation, regular review cycles, and preventive internal controls

Balance sheets remain critical for assessing financial health, securing financing, and making strategic business decisions

Peak Advisers provides expert QuickBooks implementation to maximize balance sheet accuracy and efficiency

The balance sheet stands as one of accounting's most enduring innovations, tracing its roots back over 500 years while remaining essential to modern business success. Today's entrepreneurs can leverage advanced tools like QuickBooks to manage what once required entire teams of accountants, but understanding this financial statement's rich history provides valuable context for its critical role in business decision-making.

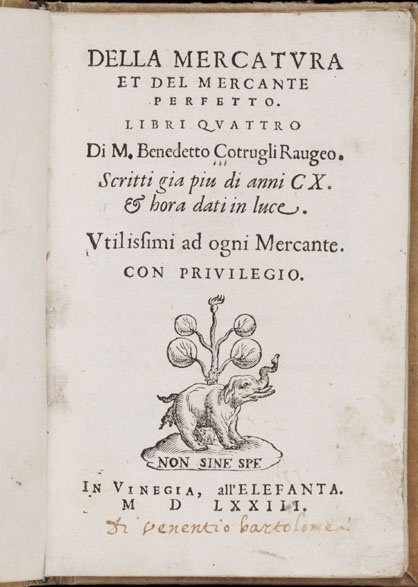

Textbook published in 1494

The Ancient Origins: From Livestock to Ledgers

Why chickens? Historically, accounting practices such as the balance sheet were first developed to track simple exchanges—often involving livestock like chickens, grain, and other basic commodities. While the records may have started with something as humble as a chicken trade, today's businesses need sophisticated tools to manage complex financial operations.

The origins of the balance sheet can be traced back to ancient times, but it wasn't until the 15th century that it began to take its current shape. Luca Pacioli, often called the "Father of Accounting," introduced the concept of double-entry bookkeeping in 1494. This laid the groundwork for what would become the modern balance sheet through his publication "Summa de Arithmetica, Geometria, Proportioni et Proportionalita."

From those early days of tracking livestock and simple bartering, accounting has evolved into the sophisticated financial management systems we use today. The same principles that helped merchants track their chickens and grain now power QuickBooks and other modern accounting platforms.

Luca Pacioli: The Father of Modern Accounting

Pacioli's system recorded every transaction in two accounts: one debit and one credit. This balanced method gave rise to the term "balance sheet" and formed the basis for accurate financial reporting. The essentials of double-entry accounting have remained largely unchanged for over 500 years.

Pacioli's contribution was significant—the comprehensive, comprehensible exposition of mathematical and accounting knowledge of his time. His work included most of what we recognize today as the complete accounting cycle: journals, ledgers, year-end closing procedures, trial balances, and ethical guidelines for accountants.

The Evolution: From Manual Ledgers to Digital Excellence

For centuries following Pacioli's groundbreaking work, creating balance sheets remained a labor-intensive, manual process. Accountants meticulously tracked every transaction by hand, creating financial statements that were both time-consuming and prone to human error.

The digital revolution transformed this landscape entirely. Modern accounting software has eliminated the drudgery of manual calculations while providing unprecedented accuracy and real-time insights.

How Modern QuickBooks Transforms Balance Sheet Management

Today's business owners benefit from sophisticated automation that would astound even Pacioli himself. QuickBooks tracks and organizes all of your business's accounting data, making it easy to access your balance sheet and other financial statements. Here's how modern technology revolutionizes balance sheet management:

Real-Time Automation

QuickBooks does the math behind the scenes so you can quickly run accurate balance sheet reports. Every transaction automatically updates your balance sheet in real-time, ensuring you always have current financial data.

Advanced Reporting Features

Access and customize over 50 accounting reports and financial statements. It's easy to share reports with your business partners, investors, or colleagues. You can even schedule them to be automatically generated and sent daily, weekly, or monthly.

Enhanced Integration and Security

QuickBooks Desktop for 2024 has arrived! New features include enhanced security with industry-leading AES 256-bit encryption, seamless background updates to ensure you're on the most recent version of QuickBooks without interrupting your work.

Balance Sheet Budgeting

Now, clients using QuickBooks Online Plus and QuickBooks Online Advanced can create balance sheet budgets for asset, liability, and equity accounts directly within QuickBooks Online. A status bar also helps them ensure their budget entries are balanced.

2025 Balance Sheet Best Practices

Based on current accounting standards and technological capabilities, here are essential best practices for balance sheet management:

1. Implement Automated Reconciliation

Automating the reconciliation process with pre-configured routines can save time and reduce human error. Automated solutions can match transactions, manage intercompany reconciliations, streamline balance sheet certification, and close task checklist management.

2. Establish Regular Review Cycles

Balance sheet reconciliation is a crucial process in financial reporting where a company's financial records are compared with the numbers on its balance sheet to ensure accuracy. Modern best practices recommend monthly reconciliations rather than quarterly or annual reviews.

3. Use Risk Assessment

Risk assessment allows accountants, controllers, and other individuals within the Office of the CFO to predict some of the risks involved with financial decisions. Doing this can help identify potential issues prior to balance sheet reconciliation.

4. Implement Internal Controls

The best way to make your balance sheet reconciliation process as effortless as possible is to prevent errors before they happen. To that end, make sure all policies involving financial transactions are absolutely clear and have internal controls in place.

The Strategic Value of Balance Sheets in 2025

Balance sheets report a company's assets, liabilities, and shareholders' equity at a specific point in time. As a result, these forms assess a business's health, what it owes, and what it owns. Understanding your balance sheet helps you:

Assess Financial Health: Monitor liquidity, solvency, and financial flexibility

Secure Financing: Demonstrate creditworthiness to lenders and investors

Make Strategic Decisions: Allocate resources effectively and identify growth opportunities

Ensure Compliance: Meet regulatory requirements and accounting standards

Track Performance: Monitor financial trends and benchmark against industry standards

Example Scenario: How Modern Tools Transform Financial Reporting

Note: This is a hypothetical example to illustrate potential benefits

Consider a growing professional services firm struggling with manual financial statement preparation that takes days each month and contains frequent errors. In this scenario, implementing QuickBooks Online Advanced with automated reconciliation and real-time reporting could potentially reduce their monthly close process from five days to less than one day.

The automated balance sheet generation would eliminate calculation errors and provide management with real-time insights into cash flow, asset utilization, and debt management. This type of improved accuracy often enables businesses to present stronger financial positions to lenders, potentially leading to better financing terms and supporting growth initiatives.

Peak Advisers: Your QuickBooks Implementation Partner

Peak Advisers offers comprehensive QuickBooks setup, training, and consultation services designed to maximize your balance sheet accuracy and efficiency. Our certified ProAdvisors ensure your QuickBooks implementation follows current best practices and integrates seamlessly with your existing business processes.

Services include:

Complete QuickBooks setup and configuration

Balance sheet reconciliation automation

Custom report creation and scheduling

Staff training and ongoing support

Integration with banking and payment systems

Compliance guidance for current accounting standards

Ready to Transform Your Financial Reporting?

Don't let manual processes hold your business back. Schedule a free consultation with Peak Advisers today to discover how modern QuickBooks solutions can streamline your balance sheet management and provide the accurate, real-time financial insights you need to grow your business.

Frequently Asked Questions

Q: What is a balance sheet and why is it important? A: A balance sheet is a financial statement that shows your company's assets, liabilities, and equity at a specific point in time. It's essential for assessing financial health, securing loans, making business decisions, and meeting regulatory requirements.

Q: How has QuickBooks improved balance sheet management? A: QuickBooks automates balance sheet creation with real-time updates, eliminates manual calculation errors, provides customizable reporting, and offers automated reconciliation features that save time and improve accuracy.

Q: How often should I review my balance sheet? A: Best practices in 2025 recommend monthly balance sheet reviews rather than quarterly or annual reviews. This allows for faster identification of issues and more timely business decisions.

Q: What are the key components of a balance sheet? A: A balance sheet includes three main components: Assets (what you own), Liabilities (what you owe), and Equity (owner's stake). The fundamental equation is: Assets = Liabilities + Equity.

Q: Can Peak Advisers help me set up QuickBooks for better balance sheet management? A: Yes! Peak Advisers offers comprehensive QuickBooks setup, training, and consultation services designed to maximize your balance sheet accuracy and efficiency. We ensure your implementation follows current best practices.

Q: What's the difference between balance sheet reconciliation and bank reconciliation? A: Balance sheet reconciliation reviews all transactions across your entire balance sheet, while bank reconciliation focuses specifically on bank statements and cash accounts. Balance sheet reconciliation has a broader scope.

Q: Who was Luca Pacioli and why is he important to accounting? A: Luca Pacioli was a 15th-century Italian mathematician and Franciscan friar known as the "Father of Accounting." He published the first comprehensive description of double-entry bookkeeping in 1494, laying the foundation for modern accounting practices.

Peak Advisers - Your trusted partner for QuickBooks excellence and financial clarity