QuickBooks keeps tracks of 2024 sales tax rate changes for you

One of the helpful tools in QuickBooks works to keep you updated on sales tax rates where you do business, even though they change all of the time.

Update QuickBooks Payroll for important tax compliance in Colorado

The Colorado Family and Medical Leave Insurance Program (FAMLI) involves a new tax that takes effect on January 1, 2023. It is now available and ready to be set up in QuickBooks Payroll. Open this blog for step-by-step instructions about how to set this up.

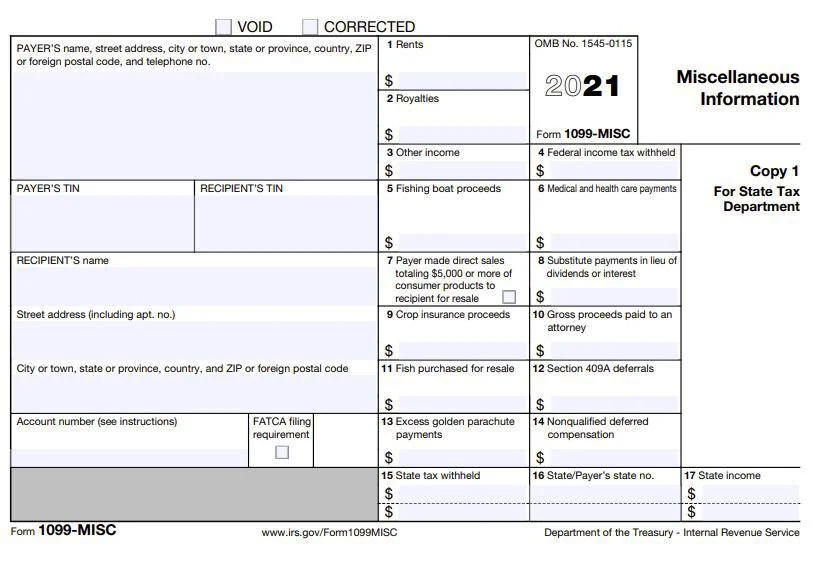

You may not need to file 1099-MISC tax forms

It is possible to never have to prepare, mail, or file a 1099-MISC tax form ever again. Read the blog to find out how.

QuickBooks Payroll: Get latest update with revised tax tables

Intuit has released Payroll Update 22106, with revised tax tables for 2021. The Payroll Update ensures that you will be in compliance with tax legislation that affects your payroll.

IRS tax form 1099-NEC: What it is, and what you need to know to use it

The IRS has made a major change to 2020 tax reporting that will impact business owners and tax professionals. Form 1099-NEC has recently been released.