The Snowball Effect: 10 things QuickBooks users can do for better workflow

We use the tools within QuickBooks as well as apps that help QuickBooks work even better when we get the Snowball Effect rolling for clients. This approach helps improve how their businesses run end-to-end.

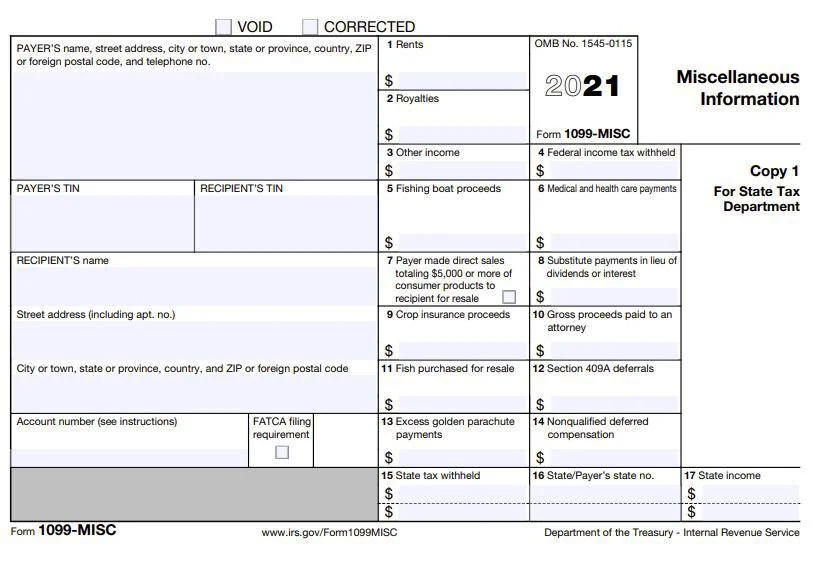

You may not need to file 1099-MISC tax forms

It is possible to never have to prepare, mail, or file a 1099-MISC tax form ever again. Read the blog to find out how.

QuickBooks Enterprise Diamond: Save on powerful business management tools

If you use QuickBooks Enterprise accounting software and other tools in Intuit’s family like QuickBooks Time or QuickBooks Payroll, you will want to consider upgrading to the Diamond version because the move will give you a noticeable and significant money savings.

Outgrowing QuickBooks? Let experts ask you one question before making a change

As a business using QuickBooks grows and matures it is necessary to ask if QuickBooks is the appropriate financial system going forward. When clients engage with Peak Advisers regarding this concern we typically respond with one question.

Condensing your QuickBooks file can be a money-saving solution

Your QuickBooks file is too big, too slow or corrupted. The ProAdvisors at Peak Advisers can help.

Action required for tax form 1099 filers

Effective for tax year 2020, the IRS has changed guidelines for reporting non-employee compensation on form 1099. The government has brought back form 1099-NEC to report non-employee compensation. If you need to file both the 1099-NEC and the 1099-MISC, you may need to update your chart of accounts in QuickBooks. Please review this post for detailed steps you must complete prior to completing 1099 forms for tax year 2020.